What you should know

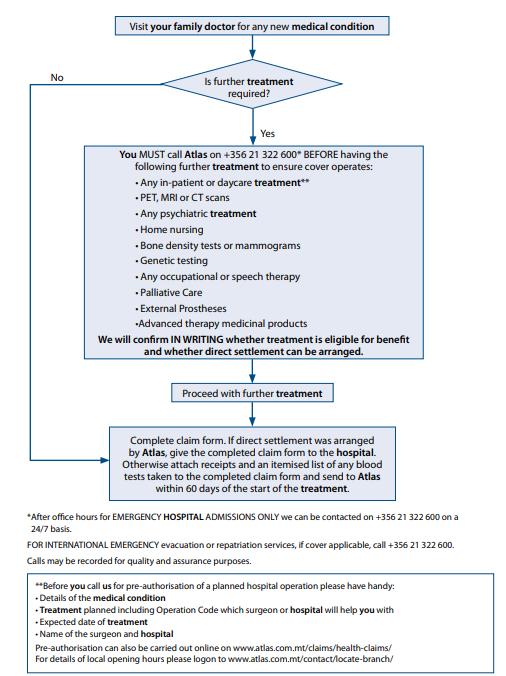

We would recommend that you use one family doctor who keeps medical records for continuation of care. Your family doctor will have a clearer understanding of the appropriate treatment for the medical condition and who should give it. Remember, if you need a specialist consultation or other treatment you must be referred by your family doctor. If you prefer, we can mail you a Claim form. To obtain a form by mail, please contact our Office at 21 322 600.

When you become an Atlas Healthcare member you will have access to a list of hospitals. These are hospitals with which, depending on the type of plan you have, we can arrange direct settlement. This means that we can settle hospital bills directly with these hospitals on your behalf subject to the terms of your plans and providing that treatment has been pre-authorised by Atlas Healthcare. This in turn will save you from having to make a pre-payment on admission. The facilities listed may change from time to time so you should always check with us before arranging any treatment. If the hospital to which you are to be admitted is not contained in the directory of hospitals, we may still be able to settle your expenses directly.

If you are receiving treatment in any part of our global network you must always identify yourself as a member to ensure that you enjoy the advantages of negotiated rates. Failure to ensure that the listed hospital recognises your entitlement to our discounted services may result in the member being required to pay any difference between the invoice value and our negotiated price.

We advise you to confirm with the hospital that it has received our written authorisation before you undergo treatment. If it has not you must contact us immediately.

Depending on your underwriting terms, we may be unable to confirm direct settlement of bills for in-patient or daycare treatment received within the first three months of becoming an Atlas Healthcare member unless we have agreed otherwise in writing. In these cases, we will consider arranging for direct settlement if you call us two weeks prior to receiving treatment.

Failure to confirm our reasonable and customary rates prior to receiving treatment particularly in countries where government price controls exist may mean you will be liable for a greater shortfall than would otherwise be the case. You must ask your chosen provider for details of any such controlled rates and contact us prior to undergoing treatment so that we can confirm what we will be able to pay under the terms of your policy.

We will not pay charges which are not reasonable or which are higher than those customarily made. This rarely happens but it is obviously important that we should only pay fees that are at the level normally charged. Our decision will reflect both domestic and international practice where appropriate and cost of living indices. Through experience we have established what is generally charged for all the procedures that we cover and we query any charges which are above that normal range. Our schedule of benefits for medical fees is also available on our website. Refer also to your membership agreement.

Private healthcare insurance is designed primarily to provide cover for new medical problems arising after joining. Depending on your underwriting terms, pre-existing medical conditions may be excluded. However, certain conditions which are unlikely to recur may be covered.

For us to determine whether treatment of a condition will be eligible for benefit, each member must, if required by us, have completed a full medical declaration, in detail, when first applying for any level of cover. Upon completion of a full medical history declaration your membership statement will clearly show the medical condition(s) for which you are not covered for treatment. We may ask for a medical report, at your own cost, to clarify the status of any medical condition.

No treatment of any pre-existing conditions, whether chronic or not, will be eligible for benefit at any time if the condition has not been declared to us on the member’s original application form and we have agreed in writing to cover the condition or we have agreed in writing that there was no need to declare it. Refer also to your membership agreement.

As you would expect, private healthcare insurance is designed to pay for treatment of unforeseen disease, illness or injury. Routine or preventive care, while it is to be encouraged, cannot be paid for by your insurance policy as this is designed to cover the diagnosis and/or cure of an unforeseen condition. Therefore eye tests, genetic testing, ECGs, blood tests, bone-density scanning, smear tests, mammograms, colonoscopies and other such tests carried out on a routine basis, as part of a screening programme or because a certain age has been reached are not covered under your policy unless specifically provided for and no payment can be made. Refer also to your membership agreement.

We do not pay benefit for medical conditions which are likely to continue or keep recurring; we pay only for the initial programme of diagnosis and treatment intended to improve or stabilise such conditions. We pay for illnesses that respond quickly to treatment in the short-term. Long-term control of illness is outside the scope of our agreement with you.

Where ongoing conditions are concerned we do, of course, try to be as helpful as we can. However we have to bear in mind that what we charge our members has to cover the cost of claims and we cannot, if we are to treat our members equitably, go on paying benefit for conditions which are likely to continue indefinitely or keep coming back.

Because of this we do not pay for routine follow-up consultations for the monitoring of medical conditions such as, but not limited to diabetes mellitus, multiple sclerosis or hypertension (chronic conditions). However if such a condition should flare up and you require admission to hospital for treatment to bring it under control then benefit will be paid for the short period necessary to re-stabilise the condition.

We therefore stop paying benefit as soon as it becomes apparent that a medical condition is chronic in nature. In such a case underwriting terms related to the condition and those associated with it may be added to your policy with immediate effect. Refer also to your membership agreement.

Applicable if shown on your benefits table)

In addition to the private healthcare aspect of your plan you may, depending on the benefits included, have access to Emergency Medical Assistance. This is a worldwide, 24 hours a day, 365 days a year emergency service providing evacuation or repatriation services.

If you need immediate in-patient treatment, where local facilities are unavailable or inadequate, a phone call to the International Assistance Company on +44 (0) 1892 513 999 will alert the International Emergency Assistance service. Please note that, for your own protection, calls may be recorded in case of subsequent query.

Please note that entitlement to the evacuation service does not mean that the member’s treatment following evacuation or repatriation will be eligible for benefit. Any such treatment will be subject to the terms of the member’s plan.